The launch of the first spot Bitcoin (BTC) exchange-traded funds (ETFs) in the U.S. market was heralded as the key to institutional adoption, but according to the results of a recent survey conducted by JPMorgan, the majority of institutional traders have no intention of making an allocation to crypto any time soon.

The bank conducted their annual e-trading survey, which included interviews with more than 4,000 institutional traders, and found that “Seventy-eight percent of traders surveyed ‘have no plans to trade crypto/digital coins,’ while twelve percent of traders have plans to trade within five years.”

This is a surprising turn for the asset class as the survey results from previous years showed a higher level of expected adoption. In 2023, 72% of respondents indicated they had no plans to trade crypto or digital coins.

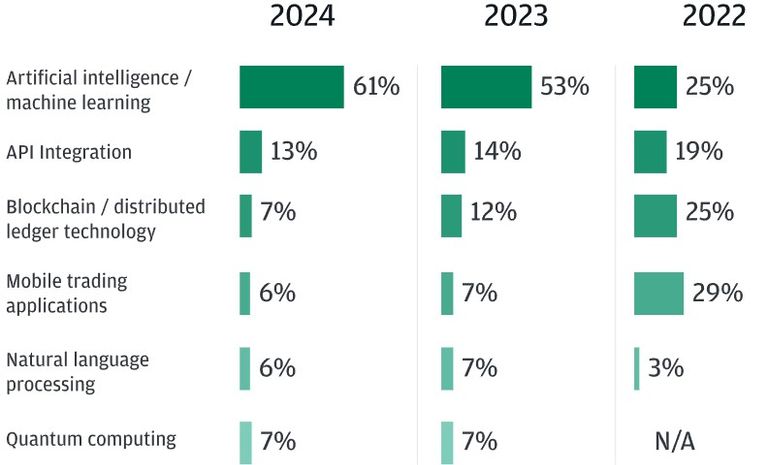

While blockchain had previously been seen as a transformative technology, 61% of respondents said they predict artificial intelligence/machine learning will be the most influential in shaping the future of trading over the next three years.

“This is an 8% increase in ranked importance since last year,” the report said. “Blockchain/distributed ledger technology decreased in ranked importance from 12% to 7% in 2024.”

The one bright spot for crypto was a slight increase in the number of traders actively engaging with the market, with nine percent of respondents saying they are “currently trading crypto/digital coins” versus eight percent in 2023.

As for the events that traders see as having the most impact on markets in 2024, 27% predicted that “inflation will have the biggest impact on markets in 2024, closely followed by 20% believing the U.S. election will have the largest impact and then recession risk, which decreased to 18% from 30% in 2023,” the report said.

Traders also expect 2024 will be a volatile year for markets, as 28% “predicted volatile markets will be their greatest daily trading challenge, closely followed by liquidity availability and then workflow efficiency,” JPMorgan said. “The significance of liquidity availability is creeping back up to regain its number one spot and has increased in ranked importance from 22% to 24% in 2024.”

Access to liquidity, regulatory change, and market data access and costs were cumulatively ranked as the top market structure concerns in 2024. “When the data was segmented by ‘product traded,’ those who trade equity derivatives or commodities have listed regulatory change as their biggest market structure concern at 30% and 25% respectively,” the report said.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Read More:JPMorgan survey finds 78% of institutional traders have no plans to trade crypto