Amidst the aftermath of the global pandemic and recent cryptocurrency market crash, Uniswap’s native UNI token rallied to an all-time high of $44.97 on May 3rd, 2021 but has since nose-dived by 53.55% landing at a current Uniswap price of $21.02

Keep reading for an in-depth study of the Uniswap price prediction for 2021 onwards. Whether you’ve been aware of the Uniswap protocol for years or have only recently found out about it, read on to learn more.

Uniswap Price Prediction 2021 to 2022

Our Uniswap price prediction for 2021 is based on examining the current trend in Uniswap coin prices, as well as Bitcoin prices, throughout the year. As expected, the Uniswap stock forecast will fluctuate between various price points as the year progresses, and our UNI price prediction takes this into consideration.

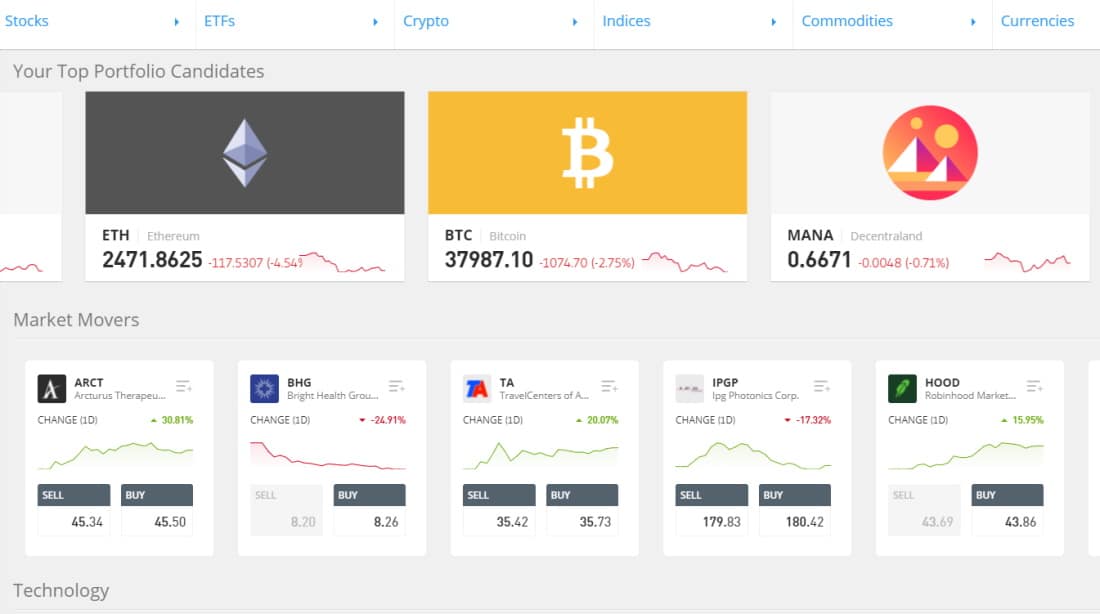

We estimate bitcoin’s price to linger around the $25.800 mark throughout September 2021, based on a careful review of its recent moving averages, as well as its performance and support and resistance levels.

Furthermore, we expect the Uniswap token price to maintain its bullish momentum during the next three months. According to data from intotheblock.com, the Uniswap token has experienced more than $439.81 million in transactions greater than $100k in the last 7 days.

Our Uniswap prediction forecasts that the Uniswap token price will reach a median price of $35.300 by the end of December 2021.

By the start of 2022, the Uniswap price forecast expects it to reach $38.166, putting it on a path to break the all-time high of $44.97 and possibly even surpass the $50 mark. According to our research the Uniswap token price is expected to sustain its recent bullish trend as decentralized cryptocurrencies gain a strong foothold in the financial ecosystem.

Uniswap Price History – the Story of 2021 So Far

Uniswap’s price has been on a rollercoaster of highs and lows throughout 2021. At the start of the year, it oscillated between the $19.50 and $30.00 range, before soaring to $44.97 on May 3rd. The price of Uniswap started to drop on May 19th during the crypto market crash. This was the month when the flagship Bitcoin giant dropped to more than three-month lows on May 19th to roughly $30,000.

The dramatic decline in the price of Bitcoin and other altcoins comes as a wave of scrutiny and from criticism, from the likes of Elon Musk to a fresh bout of regulations by China’s government, have impacted the digital coins sector that has become notorious for its dramatic volatility since its launch.

The Uniswap coin price has managed to maintain the uptrend following the recent breakout of the resistance trendline. The market price even moved beyond the resistance of $20 with the aid of rising bullish momentum.

Uniswap liquidity providers have accrued more than $900 million in trading fees since the protocol was launched. Despite its 55% plummet from its all-time highs in May, Uniswap’s weekly trading volumes have increased forty-fold representing a 900x rise when compared to the same period last year.

Furthermore, Uniswap’s market cap has reached $12,465,943,067.83 and has a market dominance of 0.79%.

Seeing as Uniswap is a fourth-generation crypto that was only launched in the third quarter of 2020, there’s not a great deal of historic price data for us to examine. However, it is worth keeping this in mind when it comes to price forecasts, as key principles such as technical analysis function by assessing historical data to reach plausible forecasts.

With that said, we can see that from an all-time low in September 2020 the Uniswap coin price has increased by just under 5,000% in under 12 months. In comparison to its initial year on the cryptocurrency market, Uniswap token price had been experiencing high volatility since the beginning of 2021. The most noticeable price change was recorded in the second half of February when its value rose by $10 before resting at the current price of $21.01. Uniswap is built on the Ethereum (ETH) blockchain and can be used to trade ERC20 tokens.

Uniswap Price Forecast

Uniswap might be on course to reach its all-time high again, but how could its market price alter during the rest of 2021? According to many crypto market analysts, the Uniswap price forecast for 2021 is strikingly bullish. Uniswap prediction 2021 places the price of UNI at an average market price of between $26 and $28, with forecasts suggesting that by the end of Q4 2021 the price could reach an average price of $35.435 and a maximum price of $46.897.

The Uniswap token price has experienced a bullish trend, and since the beginning of 2021 Uniswap has performed better than most altcoins across the board. At its record-breaking high of $44.97, the DeFi token had jumped by approximately 800% from the first fiscal quarter of 2021.

Even though Uniswap recently dealt with a bearish trend which saw a drop in over 50% of its market value, crypto enthusiasts and investors are still piling into the Uniswap market, given the protocol’s robust fundamentals.

The good news is that Uniswap has recovered in recent weeks and has overcome some big obstacles to restore the $21 support. The coin was trading at $21.01 at the time of publication.

If Uniswap can maintain the crucial support level around the $21 mark in the upcoming sessions, it could break through the major resistance line of roughly $25-$26. That type of upward trajectory may provide important momentum, enabling the Uniswap coin price to surge higher towards the key $36 psychological level.

In the short term, though, Uniswap will require support from the entire crypto market if it is to climb back towards its record highs. If Bitcoin (BTC) recovers its recent losses and moves beyond $40,000, driving a renewed bullish trend, Uniswap might follow in its footsteps.

According to Nicholas Merten, a top crypto analyst, Uniswap is currently recovering from a key support level. “Uniswap has been generally holding, albeit for a few exceptions where the wicks break a bit lower. Every time we get towards this range [0.0005 Bitcoin (BTC) or $16], buyers come in. Price doesn’t live below this line very long, and in fact, buyers come in and drive the price higher.”

Many crypto analysts forecast consolidating trends on the Uniswap price charts that suggest the token could continue its upward trajectory on a bullish sentiment and reach $50 by the end of 2021.

Many financial market watchdogs are cracking down heavily on decentralized exchanges (DEXs). Regulation, regulation, and more regulations. Financial authorities are trying to find new ways to manage and control the volatile sector that is cryptocurrency. Perhaps the biggest concern is trying to find a way to combat money laundering via anonymous trading.

This is where Uniswap comes in. Based in the US, Uniswap has a huge advantage over its competition which is not allowed to operate in the US markets. The DeFi protocol has also released its Uniswap v3 upgrade which allows traders to set their own liquidity price range.

Uniswap Price Prediction Long Term Outlook

According to Coinpedia, the Uniswap price prediction puts the Uniswap token price above $110 by the end of 2022. The site forecasts that the DeFi token will carry on riding a bullish sentiment and could rise to highs of $125 throughout next year.

Now that we have covered some of the short-term Uniswap price predictions, let’s turn to the upcoming years ahead. If you’re interested in adding Uniswap to your crypto portfolio, you must ask ‘what is the Uniswap price prediction 2025?’

Based on historical data, our Uniswap prediction points towards a significant upward trend in the coming years, with an average Uniswap token price of $100 by the end of 2023, $165 by 2025, and $210 by 2030.

On the other hand, some Uniswap price predictions for the long term suggest that Uniswap’s bullish momentum could level off between 2022 and 2025 which is a rather bleak outlook considering…

Read More:Uniswap Price Prediction