Try to sign up for any major crypto exchange today, and you might be surprised when you’re running for your passport. But, thanks to ‘know your customer’ rules, that’s pretty likely to happen – or at least you’ll have to take a selfie.

If you thought that crypto was a decentralized utopia where anonymous transactions elude regulators and big financial institutions can’t track your bitcoin, NFTs, and more, this might feel like a betrayal. But this hasn’t always been the case; it’s a pretty new phenomenon.

But why? Why do Binance, KuCoin, Kraken, Coinbase, and Bitget suddenly require your personal data to buy crypto? And doesn’t that fly in the face of the whole idea of decentralization? The answer is regulation, specifically KYC regulations.

What Is Crypto KYC?

‘Know your customer’ (KYC) means regulations and customer due diligence that financial institutions are compelled to follow regarding knowing their customers’ identities—simple, right?

Basically, anyone providing financial services has to know exactly who they’re providing them to in real-time. To do this, they have to prove that they have put KYC measures in place.

If you don’t meet these regulations, and you’re supposed to, exchanges run the risk of sanctions in whatever jurisdictions they operate in.

KYC has been introduced to the crypto world over the last few years. Regulators including the US’ SEC, and the UK’s FCA have broadened the scope of existing financial rules to include centralized cryptocurrency exchanges. To many, this may have gone unnoticed. But for those new to crypto assets, it’s especially noticeable since KYC compliance always takes place during the onboarding of new customers. Ultimately, KYC is supposed to prevent criminal activities like money laundering, terrorist financing, and fraud.

How Does Crypto KYC Work?

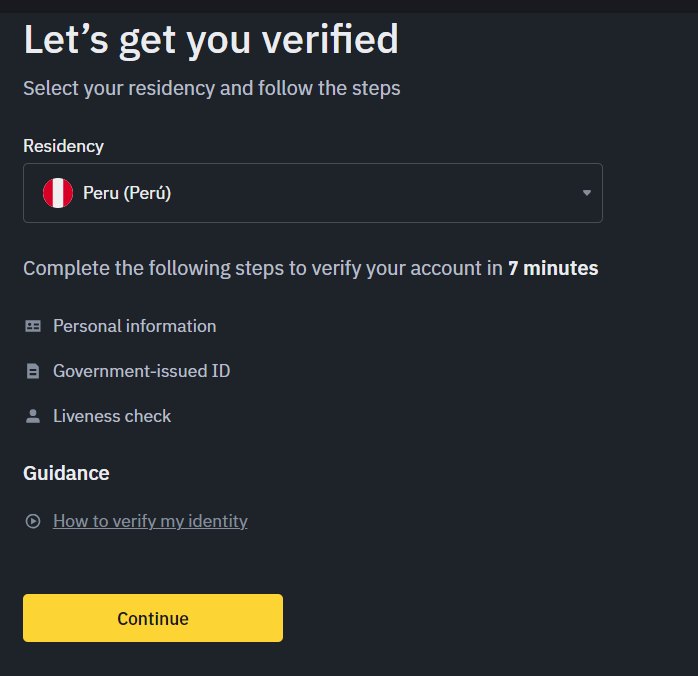

During KYC identity verification, users typically must provide personal information such as their full name, date of birth, address, government-issued identification (such as a passport or driver’s license), and sometimes additional documents or biometric data. The platform then verifies this information through automated checks or due diligence by compliance personnel.

Once the KYC process is complete and the user’s identity is verified, they are usually granted access to the platform’s full range of services. Once you’re in, you can buy and sell currencies, stake coins, and use your various crypto wallets. Just as long as you don’t commit any financial crimes, that should go without saying.

What Are the Types of Crypto KYC?

In crypto exchanges, KYC verification processes can vary in complexity and the level of information required from users. Specific KYC requirements and procedures depend on the exchange and factors such as regulatory compliance, risk management policies, and the platform’s target market. These are the major types:

- Basic KYC: Collecting basic information such as the user’s name, email address, and sometimes a phone number. Basic KYC may be sufficient for users who want to trade small amounts of cryptocurrency.

- Intermediate KYC: In addition to basic information, intermediate KYC may require users to provide more detailed personal information such as their address, date of birth, and government-issued identification (e.g., passport, driver’s license, etc.). This level is typically required for users who want to trade higher volumes.

- Enhanced KYC: Enhanced KYC involves more thorough verification processes, which may include submitting additional documents or undergoing more extensive identity checks. This is for users who want to access advanced trading features, withdraw large amounts of funds, or engage in certain high-risk activities.

- Corporate KYC: Some crypto exchanges offer KYC procedures specifically tailored for corporate entities or institutional clients. This may involve verifying the company’s legal status, identifying beneficial owners, and providing corporate documents such as registration certificates and incorporation papers.

- Geographic-specific KYC: In compliance with local regulations, some crypto exchanges may implement KYC procedures specific to users from certain geographies. These will be different depending on where you are; for example, they’re more likely to be stricter in the US, the UK, or Japan than in the Middle East.

- Tiered KYC: Tiered KYC systems involve different levels of verification based on the user’s intended activity level or the services they wish to access on the platform. Users may need to complete additional verification steps to unlock higher tiers with increased account limits or access to more features.

Why Does Crypto Regulation Now Include KYC?

Financial regulators around the world have been tightening up on the crypto industry for the last few years. Concerns about money laundering, funding for terrorism, and the lack of taxability have pushed lawmakers (and ex-presidents) to call for stricter rules. Regulatory authorities often mandate KYC verification in many jurisdictions to ensure that cryptocurrency exchanges and other platforms comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

It’s also a sign of a maturing industry, as cryptocurrency exchanges are being seen more and more as legitimate financial institutions. Gone are the days when crypto was the ‘wild west’ of finance (though some of its more niche corners could still be described as such); we’re now living in the era of serious clout for crypto’s major players. While crypto’s total market cap value counts in trillions, that’s as much, if not more, than many significant banks.

The net is tightening around crypto, that’s true, and some see it as a betrayal of some of the fundamental promises of blockchain technology. However, the flip side is that crypto has to abide by the same rules as other institutions, which means it is being seen as legitimate, which could be a step along the road to adoption in a much broader sense.

Why Choose an Exchange with KYC?

- Enhanced Security: Verifying users’ identities through KYC procedures ensures that the platform they use is secure. It helps prevent unauthorized access to accounts and reduces the likelihood of fraud, identity theft, and other scams.

- Risk Mitigation: Robust KYC helps exchanges assess the risk associated with individual users and crypto transactions. By collecting and verifying user information, exchanges can more effectively identify suspicious activity, such as large cryptocurrency transactions or unusual patterns. The exchanges can then use this information to lower their risk profile and increase functionality, providing a smoother, more secure experience.

- Access to Financial Services: KYC verification enables users to access a wider range of financial services and features offered by crypto exchanges. Users who complete the KYC process may have higher transaction limits, access to advanced trading features, and the ability to participate in initial coin offerings (ICOs) and token sales.

- Legal Protection: Implementing KYC procedures can provide legal protection for crypto exchanges by demonstrating their efforts to comply with regulations. During audits or investigations, exchanges with KYC processes are better positioned to avoid sanctions or penalties. This means anything you have to do with the exchange isn’t hampered by sudden legal troubles.

- Reduced Fraud and Chargebacks: KYC procedures help exchanges verify the identity of users before they can deposit funds or execute transactions. This reduces the risk of fraudulent activities, such as unauthorized account access, stolen credit cards, and chargebacks, which can result in losses for both the exchange and its users (you).

What Are The Cons of Crypto KYC?

- Data Breaches: Storing large amounts of user data for KYC purposes increases the…

Read More:KYC in Crypto: The Real Reason Exchanges Need Your ID