Ethereum has enjoyed a healthy start to 2024, and seems to have its sights set even higher with multiple positives events on the horizon for the world’s second largest cryptocurrency. Can ETH sustain its bullish momentum or is a correction on the horizon?

This article dives deep into the key drivers of ETH’s price as well as on- and off-chain analytics to give you our Ethereum price prediction between 2024 and 2030.

Ethereum Price Prediction Summary

- Ethereum’s current price is $4,018.53 up over 150% in the past year.

- After reaching its all-time high (ATH) of $4,891.70 in November 2021, ETH lost 80% of its value. It has since regained over 3/4 of that and sits just 17.85% down from its ATH.

- Our Ethereum price forecast estimates that ETH could range between $1,800 and $6,500 for the rest of the year.

| Year | Minimum Price | Average Price | Maximum Price |

| 2024 | $1,800 | $4,500 | $6,500 |

| 2025 | $4,500 | $7,600 | $10,700 |

| 2030 | $7,400 | $9,800 | $12,200 |

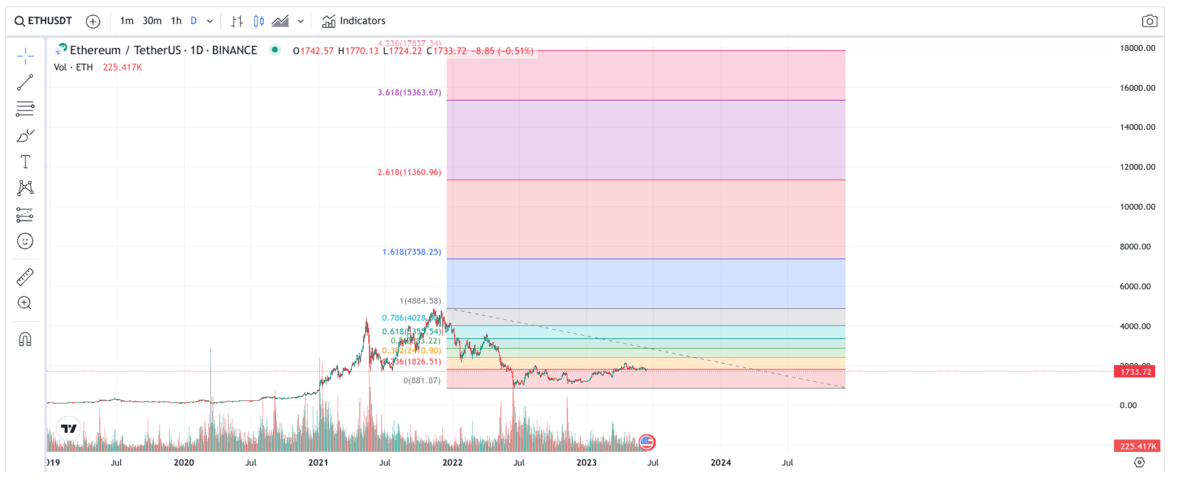

Ethereum Price History

Ethereum launched through an ICO in 2014 for $0.311 per coin. Until January 2016, it mostly traded for less than $1. However, in January 2018, the price reached an ATH of $1,270. The price exploded again in 2021, eventually creating its current ATH, on 16 November, of $4,891.70.

After this all-time high, the crypto bear market started, which saw the Ethereum price sink to lows of $890 on 18 June 2022.

Since these lows, the Ethereum price has been trending upwards. It climbed above $1,000 and found support there at the end of 2022.

The Ethereum price endured high volatility throughout 2023, hitting highs above $2,000 and lows near $1,000. One of the main causes for this was the actions of the SEC in the USA, who sued the two biggest crypto exchanges, Binance and Coinbase, in the June and were battling in court with Greyscale regarding its rejection of Grayscale’s Bitcoin ETF—they eventually lost this case in mid-October.

At the end of October the whole of the crypto market received a boost from the expectation that a Bitcoin ETF would be approved in the coming months and ETH finished the year at $2282.11, 91% up from January 1st.

On Bitcoin ETF approval day, January 10th, 2024, Ethereum gained as much as 12% on the expectation that it would be the next token to have an ETF approved. After a brief slump, the crypto markets and Ethereum rallied.

This sent the price of ETH climbing, and just 2 months after ETF approval Ethereum topped $4,000.

Ethereum price history key points:

- Ethereum launched through an ICO for $0.311 in 2014.

- The coin traded under $1 for most of 2015.

- In 2018, the price exploded to $1,270 but was followed by a bear market.

- Ethereum reached its ATH of $4,891.70 in November 2021.

- ETH is currently down 17.85% from its ATH but up 351% from its recent bear market lows.

Ethereum Price Prediction 2024

In early 2024 a crypto bull market is seemingly underway, with Bitcoin hits new ATHs and meme mania hitting the markets. This is widely expected to continue, with an upcoming Bitcoin Halving event in April—which has historically triggered bull markets each time it has occurred (which is once every four years).

There is also the possibility of the approval of an Ethereum ETF in May, which would be hugely bullish for the Ethereum price. However, top analysts have recently revised down their expectations of approval, from 70% to 30%.

However, all assets carry risks, and there are multiple factors that could negatively impact the future price of Ethereum and other cryptocurrency price predictions.

For example, macroeconomic factors could worsen and dampen any hopes of other top cryptos reaching new ATHs. One of the biggest indicators of improving macroeconomic factors is cuts in the interest rate in the world’s biggest economies—like the USA. While hope for this was high at the start of the year, it has faded slightly as the Fed are yet to reduced interest rates. Many experts are now not expecting cuts until the latter half of the year.

Another consideration is that the SEC could file a lawsuit against Ethereum, particularly since SEC chair Gary Gensler has refused, last year, to say that ETH is not a security.

Nevertheless, there are numerous factors, besides the Bitcoin Halving event and ETF approval, which could help ETH grow in 2024. For example, the regulatory framework for crypto continues to take shape in countries around the world, providing investors and users with assurance of how crypto is going to be treated by regulatory bodies and governments.

It is notable that the USA lags behind the rest of the developed world with its regulating of the crypto industry, introducing various bills to regulate the industry, but not yet passing any of them into law. While legislation in the USA isn’t the be-all-and-end-all of crypto legislation the news does always weigh heavily on the price of the top cryptocurrencies.

All this being said, the Bitcoin Halving event in April 2024 is the only certain piece of news for the crypto markets. With that in mind we expect that ETH could track along with Bitcoin and post new ATHs of $6,500 in 2024.

If, however, the global economic outlook looks rocky in 2024, we could see ETH struggle to reach an ATH and, as a result, predict an average ETH price of $4,500 in 2024. If the global economic situation takes a downturn in 2024, or ETF approval takes a long time (or doesn’t come at all), we could see ETH struggle to retake previous high, and are, therefore, predicting a low of $1,800 for ETH in 2024.

Ethereum Price Prediction 2025

Provided the crypto bull market occurs in 2024, we can expect Ethereum to continue to create new ATHs in 2025. Bull markets typically last 18 months, so if it begins in Q1 2024, Q3 2025 will likely be when it peaks.

Generally, each bull market produces less growth from its previous ATH for established cryptos. This is because as an asset matures, the amount of liquidity needed to boost its price increases. In other words, the most volatile cryptos are usually newer with lower market caps.

For example, according to CoinMarketCap, Ethereum reached a $1,270 ATH in 2018, an 6,600% increase from its 2016 ATH of $18.9. Comparatively, the difference between its ATHs in 2018 and 2021 was only 285%.

However, it is also worth noting that Ethereum’s transition from Proof-of-Work to Proof-of-Stake has led it to be labeled as “ultra sound money” by some, because a small percentage of ETH is burned from each transaction, potentially making it a deflationary asset. ETH inflation or deflation can be tracked at Ultrasound.money.

A bull market also results in increased interest in Ethereum, the #2 cryptocurrency, and, as a result, network activity also increases. This means that the total amount of ETH in circulation decreases considerably during a bull market, increasing the scarcity of an in-demand asset and putting upward pressure on its price.

With this in mind, our Ethereum price prediction forecasts that Ethereum could increase as much as 120% from its current ATH, leading ETH it to highs of $10,700 by the end of 2025.

Our average expected Ethereum coin price forecast is $7,600 and we predict potential lows of $4,500 in 2025.

Ethereum Price Prediction 2030

Due to the turbulent nature of the cryptocurrency industry, it is difficult to say where Ethereum will be by 2030.

There is a possibility that Ethereum could see mass adoption, with governments, companies and individuals utilizing it for a wide array of use cases, from a means of payment to decentralized social media.

On the other end of the spectrum, smart contract exploits or a global crackdown on decentralized cryptocurrencies with the intention of implementing central bank digital currencies could considerably stunt Ethereum’s growth.

Ethereum will undoubtedly face trials and tribulations in the future, yet it has the capacity to provides tremendous value and utility and is seen as one of the most promising cryptocurrencies.

With…