Quick Take

Let’s examine the share price performance of publicly traded companies that have adopted Bitcoin (BTC) as a treasury asset, excluding mining companies.

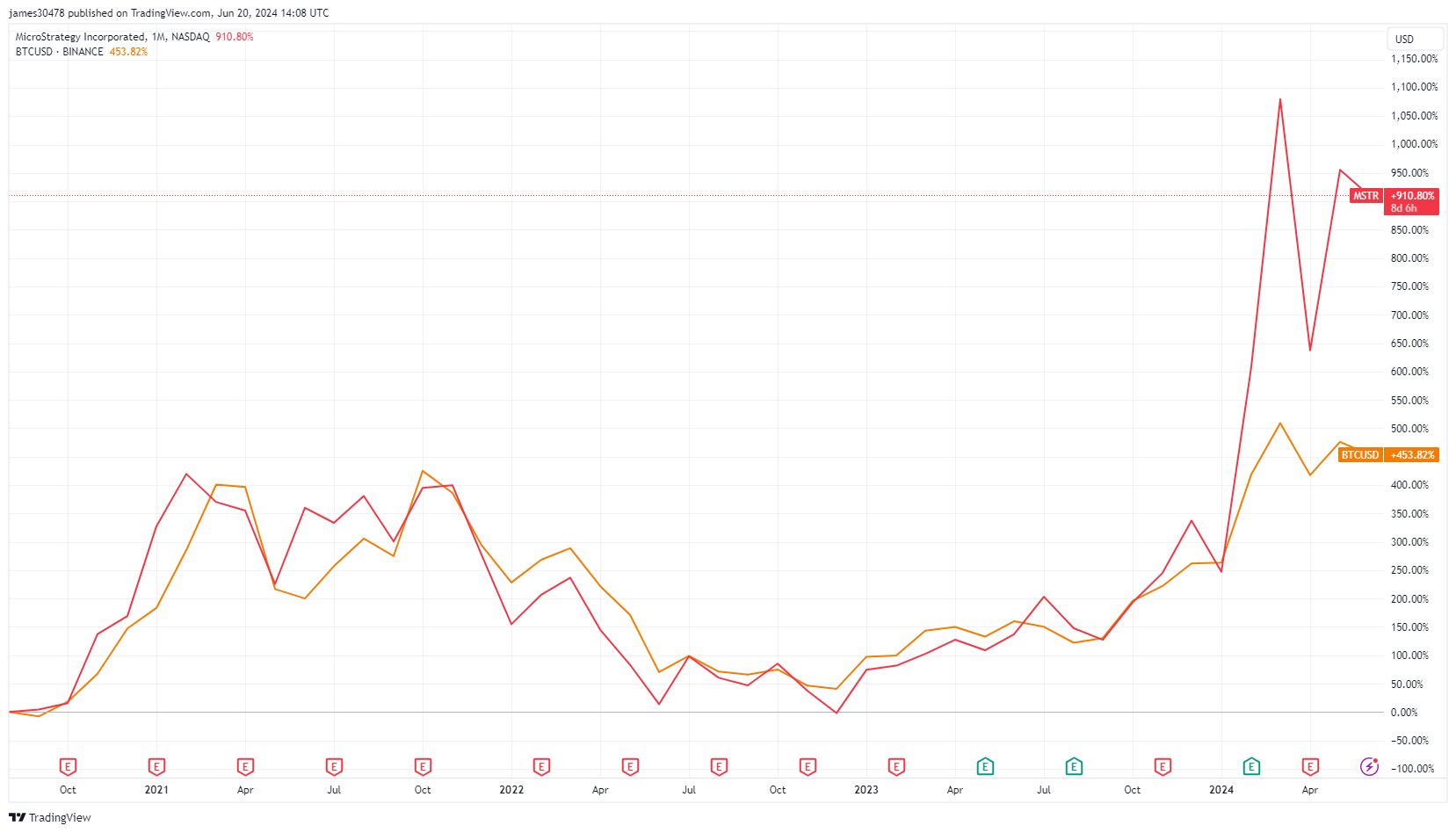

The most notable example is MicroStrategy, which adopted BTC in August 2020. At that time, its share price was around $130. By March 2021, it soared to $1,300. Despite hitting a bear market bottom of roughly $130 in January 2023, MicroStrategy’s share price is now trading just under $1,500. MicroStrategy’s stock has surged by over 900%, significantly outperforming Bitcoin, which has increased by over 450% during the same period.

Next, Metaplanet, a Japanese publicly traded company, announced its BTC adoption on April 8. Since then, its share price has surged by 326%, despite Bitcoin’s price declining by 6% in the same period. Metaplanet has continued to buy more Bitcoin since its initial announcement.

Semler Scientific announced on May 28 that it had purchased 581 BTC as a treasury asset. Since then, its share price has increased by over 60%, while Bitcoin’s price has fallen by 5%. Semler Scientific has also made additional Bitcoin purchases.

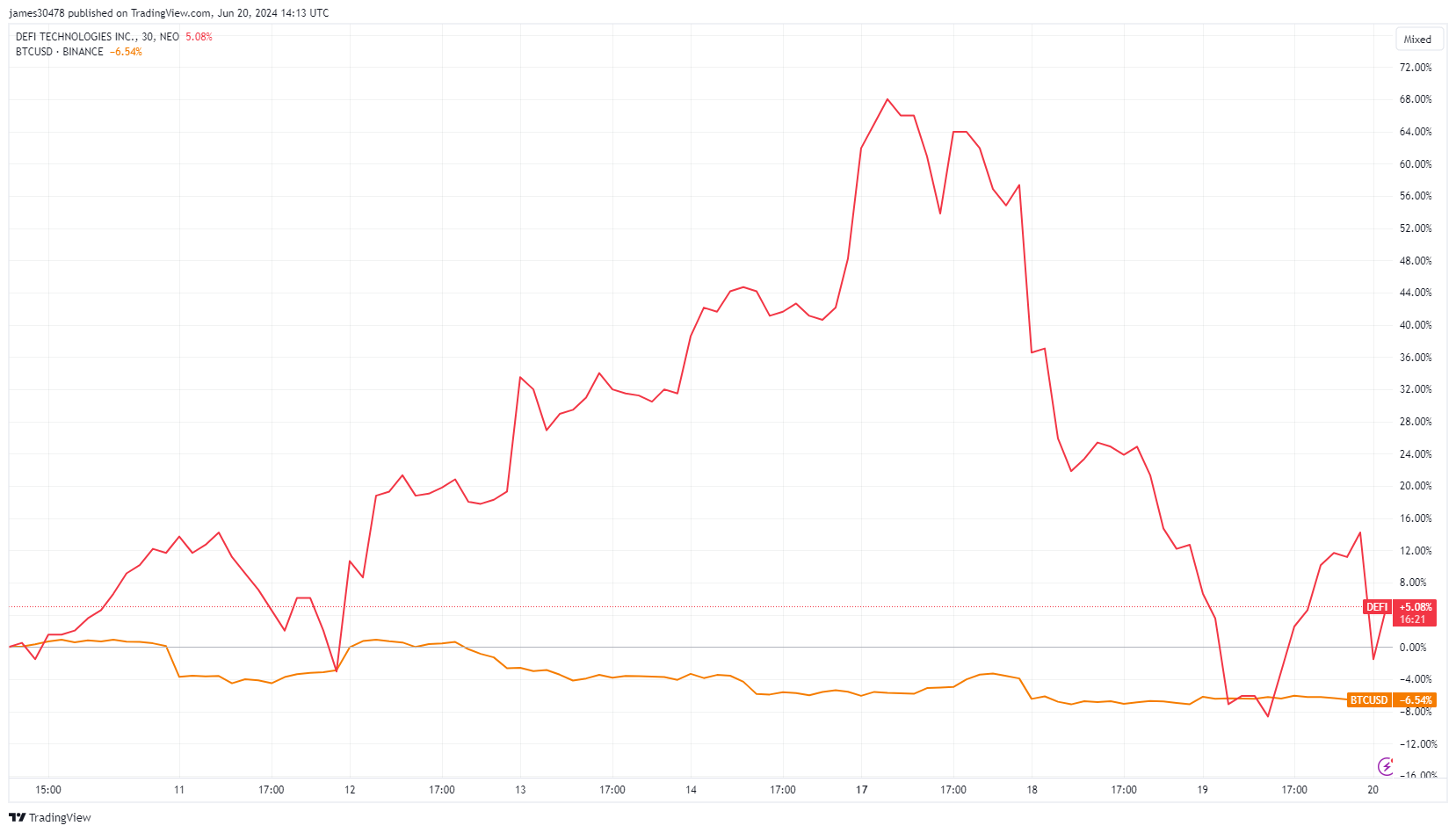

DeFi Technologies first announced its purchase of Bitcoin as a primary treasury reserve asset on June 10, 2024. The company’s share price has increased by over 6%, peaking at over 68% on June 17, despite Bitcoin’s price dropping by nearly 7%.

Tesla is excluded from this analysis as Elon Musk has not stated that it uses BTC as a treasury asset; the share price is currently down 30% from when Tesla first bought Bitcoin back in 2021 and sold at least 75% of it. Additionally, Coinbase is excluded because it held cryptocurrencies on its balance sheet before its IPO in 2021.

Read More:Public companies adopting Bitcoin as treasury asset see shares soar