Bet_Noire

Marathon Digital (NASDAQ:MARA), the well-known Bitcoin (BTC-USD) miner, reached a peak price during the last Bitcoin bull market, at around $76 per share in November 2021. The stock currently trades at around $19. Shares outstanding at the November 2021 high were 102.63 million shares, while shares outstanding today are 282.79 million shares. There has been a 175% dilution since November 2021. Reaching the previous all-time price at the current number of shares would mean a market cap of around $21.5 billion. This is around the combined market cap of all U.S.-listed Bitcoin miners. This is worth noting before moving into the rest of this article.

The last Bitcoin bull run followed the third halving event in 2020, and many investors and analysts consider the halving event a strong catalyst for a Bitcoin price rally. The fourth Bitcoin halving event took place two months ago, and this sentiment of a price rally ahead is strongly shared among Bitcoin investors. A Bitcoin price rally typically extends to Bitcoin-linked stocks. During a Bitcoin bull market, Bitcoin companies that have shown efficiency in operations, good financial performance, or launched innovative products and services easily pick up on the Bitcoin-driven momentum.

BTDR | CLSK | CORZ | BITF | MARA | |

Jan. – Apr. average BTC mined | ~292 | ~687 | ~907 | ~303 | ~915 |

May (post-halving) BTC production | 184 | 417 | 448 | 156 | 616 |

Post-halving percentage -/+ | -37% | -39% | -50% | -48% | -32% |

Following the recent halving event, miners have seen their monthly BTC production reduced (the halving event slashed block rewards in half). Marathon Digital’s post-halving efficiency is worth noting; the company was the least impacted by the halving in terms of monthly BTC production, following the operations updates released by miners in May. MARA’s production declined by ~32% compared to the average BTC produced between January and April – the lowest reduction in production among publicly traded Bitcoin miners.

I’ve covered Marathon Digital two times in the past, the first coverage was in August last year and the second was in January. I was bearish on MARA in my August article due to the over 300% YTD non-catalyst-driven price surge the stock recorded at that time; however, in January, I saw the potential in the surge in transaction fees on the Bitcoin network as Bitcoin Ordinals were recording heightened activities, and I highlighted how Marathon Digital stood to gain from the heightened Ordinals activity (considering Marathon Digital runs its own mining pool), not also forgetting the momentum that was building around the spot Bitcoin ETF approval. Based on these factors, I gave MARA a rating upgrade to “hold” in January.

After the halving event, Marathon has proven a high level of efficiency and continues to work towards all-round vertical integration. Marathon Digital’s approach to mining operations efficiency is somewhat unique. The miner uses proprietary technology across software, firmware, and hardware, thus controlling several critical business variables for favorable operations. The latest addition to Marathon’s proprietary tech stack is its next-gen immersion cooling solution.

Most analyses of BTC miners focus mainly on hashrate growth and electricity capacity, covering metrics like mining rigs output and the miner’s energy capacity (Th/s and MW). The effects and importance of efficient cooling systems for effective mining operations often take a back seat. I, however, consider cooling as a dark horse in Bitcoin miners’ operational effectiveness.

Marathon Digital Spearheads Two-phase Immersion Cooling in Bitcoin Mining

Marathon Digital is a company that has always been big on optimization in both hardware and software, and this has set the company apart among Bitcoin miners. The company unveiled a two-phase immersion cooling (2PIC) system – the 2PIC700 tank at the Empower Conference in late March, in Houston – as an addition to its proprietary tech stack. There is a growing market demand for enhanced cooling solutions (like immersive cooling) driven by the increasing need for higher processing speeds and overclocking capabilities in high-performance computing (HPC) clusters used mainly for AI processing.

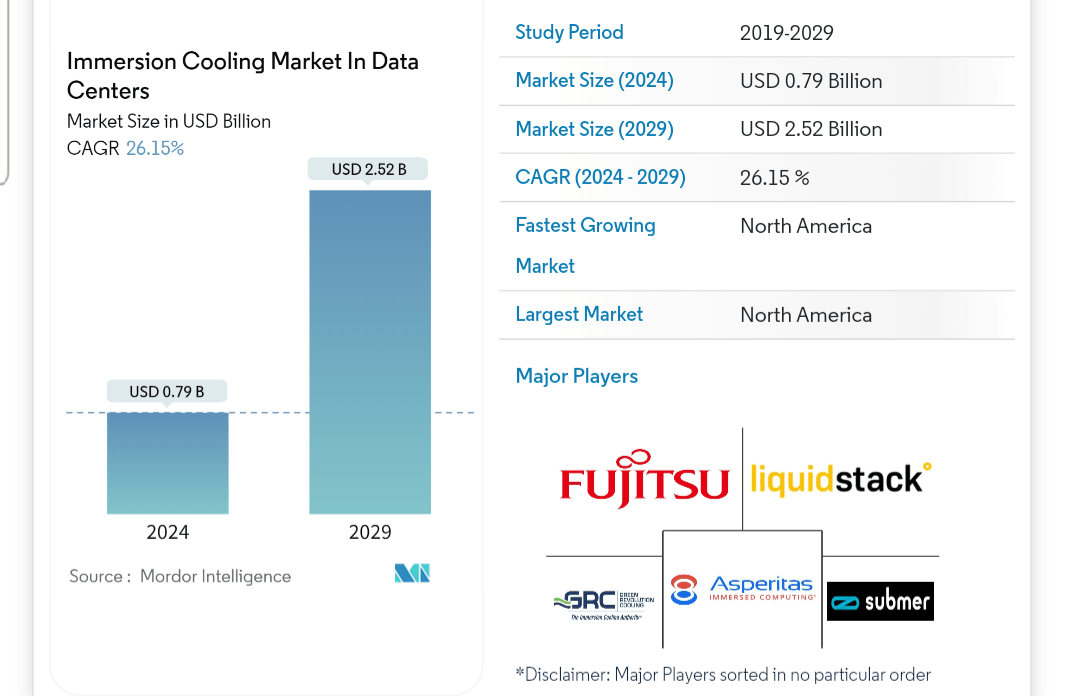

Modor Intelligence

Reports by market researchers suggest that the immersion cooling market in data centers will grow by ~26% CAGR between 2024 and 2029, reaching a $2.9 billion market size from the current ~$790 million market size. Note that this growth projection specifically focuses on immersion cooling adoption within HPC data centers.

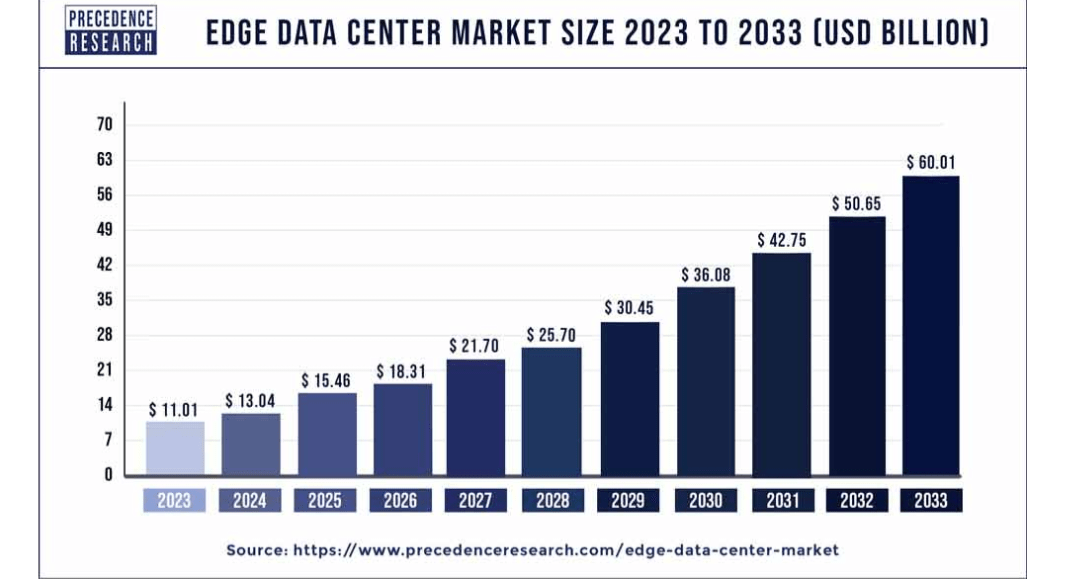

Edge data center market growth (Precedence Research)

Other emerging tech sectors, like edge AI and IoT systems, could also very much see two-phase immersion cooling adoption at the edge; hence, the potential market size is much larger. The edge data center market size is projected to grow at around 18% CAGR, to reach a $60 billion market size by 2033, according to Precedence Research. Edge computing involves processing data in real-time near the data source; hence, the need for very fast processors in a constrained space. 2PIC gives the ability for computing power to be packed into a much smaller space while maintaining optimal chip temperature.

The immersion cooling technique has been around for a while and has already witnessed some adoption in cloud data centers as well as in the Bitcoin mining sector. Alibaba (BABA) adopted immersion cooling for its data centers some years ago and has reportedly achieved better efficiency, recording a lower Power Usage Efficiency (PUE) at some of its data centers that have implemented immersion cooling.

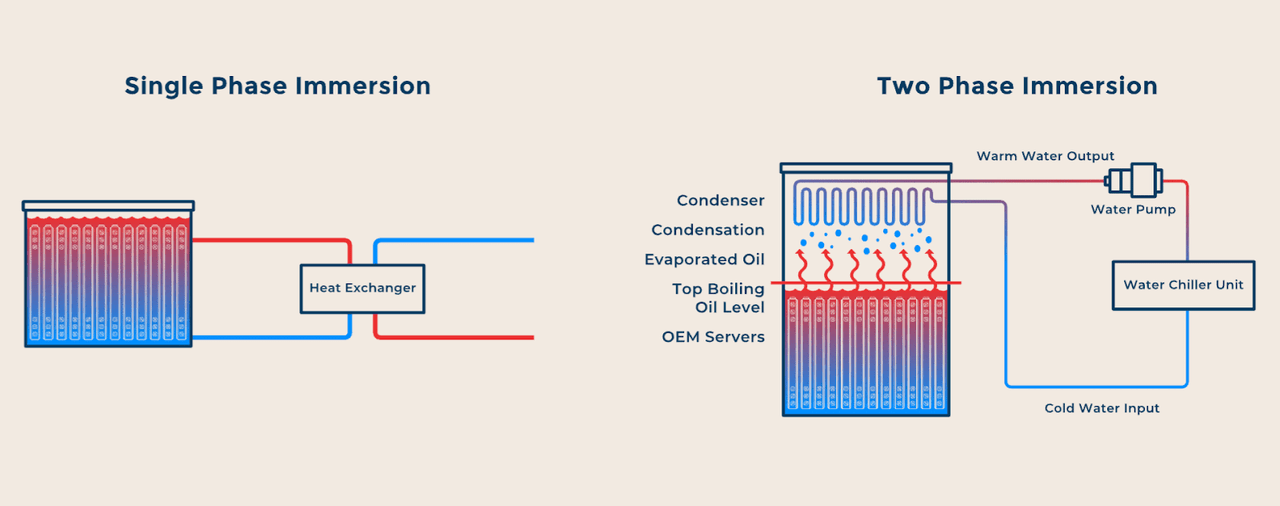

Currently, the well-known and widely-used immersion cooling technique is the single-phase immersion cooling (SPIC). In SPIC, computer components or ASIC miners (in the context of Bitcoin mining) are submerged into a single-phase hydrocarbon dielectric liquid coolant. The process is called single-phase because the liquid coolant doesn’t change its state in the cooling process. The primary advantage of SPIC is its much higher power density compared to non-immersive cooling techniques.

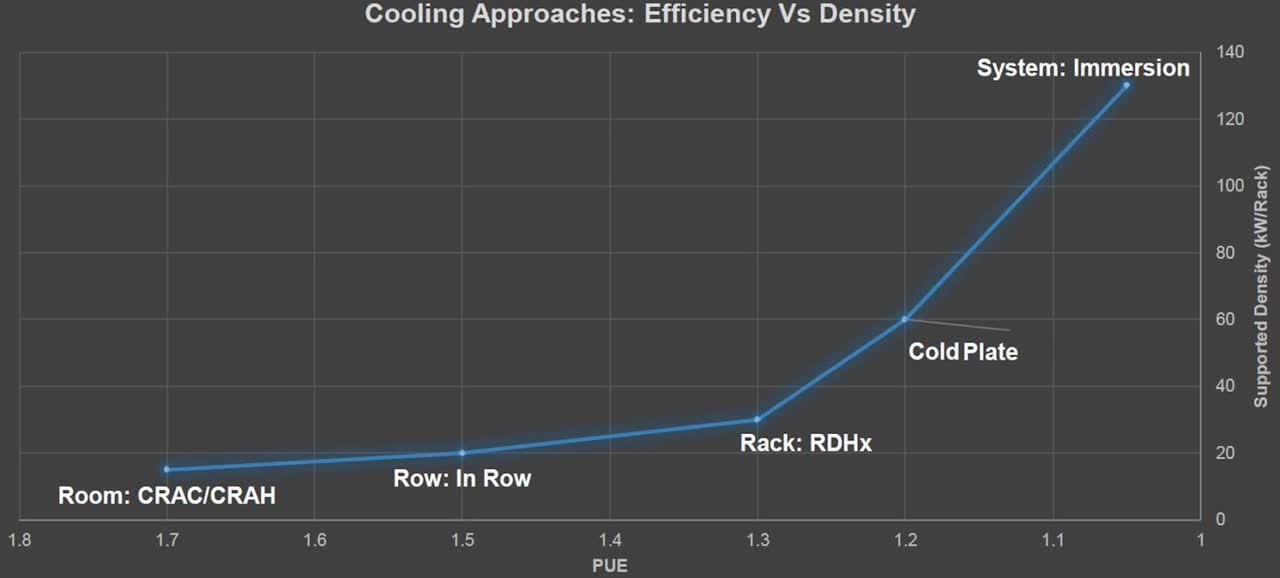

Cooling units efficiency and power density curve source (Open Compute Project)

The graph above is from a presentation at the Open Compute Summit in 2018, comparing efficiency and power density among different cooling units. Here we see immersion cooling has the lowest PUE (best efficiency) and the highest power density (highest capacity).

Single-phase and two-phase immersion cooling illustration (Marathon Digital)

The latest iteration of immersion cooling is 2PIC. Just like SPIC, the 2PIC technique involves submerging computer components or ASIC miners (in the context of Bitcoin mining) into fluorinated dielectric fluid or coolant. The fluoride liquid cools the ASIC miners in a purpose-built tank. As heat is generated by the miners, the coolant absorbs latent energy, causing some of the fluoride liquid to transition into a gaseous state. Water-cooled coils acting as condensers at the top of the purpose-built tank condense the gaseous fluorinated fluid back into its liquid form, allowing it to return to the bottom of the tank for the cooling cycle to continue. This method, involving the change of state of the coolant, creates a more efficient cooling solution over SPIC. Fluorinated fluids in a gaseous state require less energy to cool back to liquid form compared to the cooling of hydrocarbon oils or coolants in the SPIC technique. In Bitcoin mining, improved cooling directly translates to higher realized hashrate as mining rigs will perform at their optimum if adequately cooled.

Also, the adoption of immersion cooling in mining facilities significantly reduces overhead power consumption by minimizing the need for additional components that draw extra energy, such as large fans, external pumps, or heat exchangers, which are core components in air-cooled and hydro-cooled setups, giving the facility a better PUE…

Read More:Marathon Digital: The All-Round Vertically Integrated Bitcoin Miner (NASDAQ:MARA)