spawns

If an investor, professional or otherwise, comes out with an opinion that Bitcoin’s price is more likely to fall than rise, they had better have two things:

1. A good reason to be speaking out against the barrage of excitement, hype and downright giddiness of the investing public, following the listing of the first 11 spot Bitcoin ETFs, including one from ETF giant iShares, the iShares Bitcoin Trust (NASDAQ:IBIT).

2. A decent quote about being wrong. Because the “cost” of being wrong if Bitcoin goes to $100,000, a round number that some prognosticators like to use as a price target because they are not as bold as Fundstrat’s Tom Lee who sees $500,000 as an eventual destination. So here’s the quote on being wrong, from Ken Robinson: “If you’re not prepared to be wrong, you’ll never come up with anything original.”

Front running in some forms is illegal on Wall Street, but not when you are being the ultimate contrarian and daring to go the opposite way of folks like a sports radio host I follow who apparently is also a huge cryptocurrency proponent. Why let the offering of unlicensed personalized advice to the masses get in the way of a good story?

Then there’s my good friend and former investment industry professional, who has never asked me an investment question in the decades we’ve known each other. Then, the text comes through the other day: “so, do you have an opinion on whether people should buy Bitcoin ETFs?”

I am not at all surprised by the thrill surrounding the launch of these products, even if SEC Chairman Gary Gensler apparently does not share the enthusiasm. But it passed, barely, and now the firehose of activity and demand can take its natural course. Day 1 was epic in terms trading volume. Day 2: not so much.

This is the type of Google search I think we’ll all see more of now. Day 1: “inflow race” and day 2: “failed on the expectations.” We haven’t seen this type of “every day’s a new ballgame” situation on Wall Street since, well very recently. This hyper-focus on cryptocurrency is like the chatter before every Fed meeting, except greater by a factor of 100,000. You know, where Bitcoin’s price is allegedly going really soon.

Google search

Look, I started this article by saying I’m not afraid to be wrong. But since I’ve seen every step of the financial markets’ ever-evolving story since 1986, I smell a bubble here. Not for a moment do I doubt the validity and future promise of the blockchain. And, I’ve already written that I don’t consider myself a crypto expert, not by a longshot. But I do read charts, and have for 44 years. And I invested other people’s money through the Dot-Com Bubble. So if nothing else, I have opinions. And since my family is sick of hearing them when it comes to the spot Bitcoin “event” I’m placing my views here.

No favorites, but IBIT is the one spot bitcoin ETF worth following and here’s why

iShares

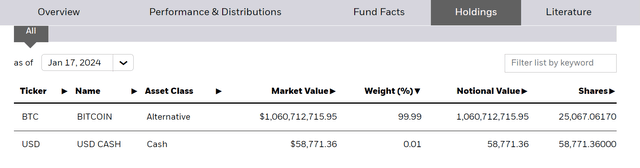

The above image from iShares’ website, is what bitcoin fans have been hoping they would see one day: an exchange-listed product that holds Bitcoin. Not futures, not Cayman Island LPs, spot bitcoin. Ironically, you can’t technically “hold” a digital coin, but perhaps that’s the entire cryptocurrency story. It is not tangible, so it can be tied to a single owner, and only that owner can control what it is used for.

Of all the bitcoin spot ETFs, the one that I’m keeping a close eye on is IBIT. Not because it’s ticker symbol looks more like my last name than any I’ve ever seen (thanks, iShares!). It is because if iShares can’t crush it with asset raising in something, there’s probably something wrong. I’ve highlighted some iShares ETFs that are somewhat under the radar, but that’s usually because they focus on very hyper-niche areas of the markets that don’t get much attention. The giant unit of Blackrock has no such excuses with IBIT.

IBIT: the basics

IBIT is already crossed $1 billion in assets (as of Wednesday’s close). It’s fee will eventually be 0.25% if/when it hits $5 billion in assets. and just 0.12% before that time, unless its first 12 months passes without reaching that asset target. In that case, IBIT will go to 0.25% anyway.

There’s not much to these ETFs in terms of traditional ETF data. They don’t have a track record, but we should assume they will track the underlying bitcoin spot price nearly spot-on, pardon the pun. That’s the whole advantage of ETFs over mutual funds: transparency. You know what you are getting, plain and simple. And every day, that holdings basket (simple in the case of IBIT) is updated.

IBIT’s trading volume is in the area of $500 million per day, albeit with a very small sample size, since it just started trading. We’ll see how that settles out over time, but if 50-75% of the outstanding asset base turns over daily, that is by definition a day trading vehicle. I know there’s a bitcoin buy and hold crowd, the question is whether we will find them easily among the traders. Just as there are options trading professionals, the 0DTE (zero days to expiration) version of those products has a similar situation going on.

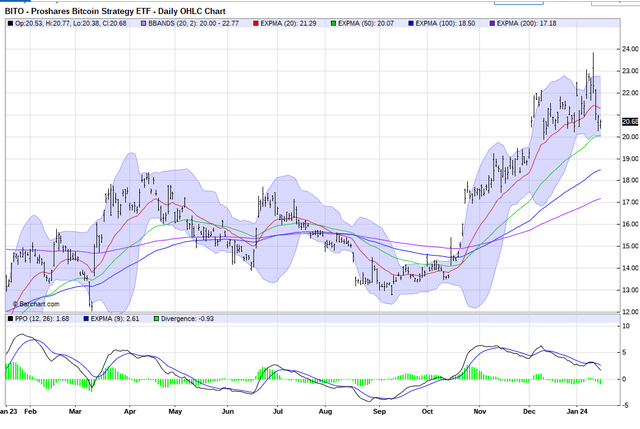

In time, I’ll be able to track spot bitcoin’s price using technical analysis, just as I do for hundreds of other market segments. But for now, I find that BITO is a good proxy, and that’s the one I’ve been using in my trading for the most part, as noted earlier. Over time, I suspect IBIT will be my chosen “spot bitcoin proxy ETF” but I’ll need a good 12 months of price data, and even then I’ll use it in combination with the “legacy” ETFs like BITO.

Bitcoin: where greed meets traditional market metrics

Here’s a summary of my bottom-line on Bitcoin ETFs, a week after their birth on US stock exchanges:

1. The technical price pattern for Bitcoin looks weak and getting progressively weaker. I have had more success as an investor than at any other time when I pay some attention to market “narratives” and lots of attention to what the market is actually doing via price.

This chart below is what I’d call, to use some technical analysis lingo, “not a happy chart.” The top section shows the price threatening to roll over, and the 20-day moving average, which is one of my favorite snapshot short-term indicators, just having turned down. That happened twice in 2023, and each time it led directly to a 20% “dip” in the price of ProShares Bitcoin Strategy ETF (BITO), a spot bitcoin predecessor which I’ve traded here and there, as well as its inverse, the ProShares Short Bitcoin Strategy (BITI). I’ve also traded call and put options on BITO.

Barchart.com

And that’s really my point. Bitcoin can be fun and profitable to trade. It moves fast at times, and it isn’t levered, but behaves like some 2x and 3x ETFs on more mundane underlying investments, like the S&P 500 and Nasdaq (I can’t believe I just wrote “mundane” about those two, but there you have it).

But as for Bitcoin as a “store of value” and an asset that can be trusted by buy-and-hold investors. Like I said, I’m as prepared to be “wrong” as I’ve ever been. But the Dot-Com Bubble was just like this. I mean really just like this. Ideas that couldn’t miss, and “haters” swarming around any opposing viewpoints. But if Wall Street history means anything, Bitcoin is at best a trading vehicle whose price will eventually mature, and as the attention fades, these new ETFs will become regular members in good standing on the stock exchanges. But like gold, silver and even natural gas, uranium and lithium, they will trade more like commodities than listed securities that “everyone” wants a piece of.

Frankly, the crypto with the most potential, from my somewhat informed but not expert-level understanding of this area, is Ethereum. It has an added dimension over bitcoin which allows us to play a more instrumental role in conducting transactions not overseen by public authorities or banks. And for the truly committed business people involved in crypto and blockchain activities, that’s intriguing.

It is the “number go up” aspect of…

Read More:My Favorite Spot Bitcoin ETF: None Of Them, IBIT Now A Bitcoin Indicator