Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

Once someone decides that they want to hold bitcoin in self-custody, they will soon discover that hardware wallets are the most secure tools for managing bitcoin keys. The next question becomes whether to use a singlesig wallet or a multisig wallet.

If you choose to use multisig to secure your long-term savings, you will also need to decide whether you want to set it up all by yourself, or in collaboration with others. Both of these approaches have their own set of trade-offs, and in this article we will compare and contrast them.

Do-it-yourself (DIY) multisig

An attractive characteristic of bitcoin is that it allows people to become more self-sovereign with their wealth. If you’re someone who emphasizes the importance of this feature, your initial reaction to collaborative custody multisig may be one of skepticism. You might instead be considering setting up multisig by yourself, without involving anyone else in your arrangement.

A multisig wallet can be set up by using one of several free and open source wallet softwares, such as Caravan, Sparrow Wallet, or Electrum. They allow you to combine extended public keys (xpubs) to build the multisig quorum you want. This approach has a couple of advantages—it gives you the opportunity to customize the structure to suit your needs and potentially retain more privacy than collaborative multisig.

Collaborative custody multisig

Although “collaborative custody” may seem like an alternative to self-custody, these labels are not mutually exclusive. In a thoughtfully designed multisig structure, both terms can accurately describe the same situation.

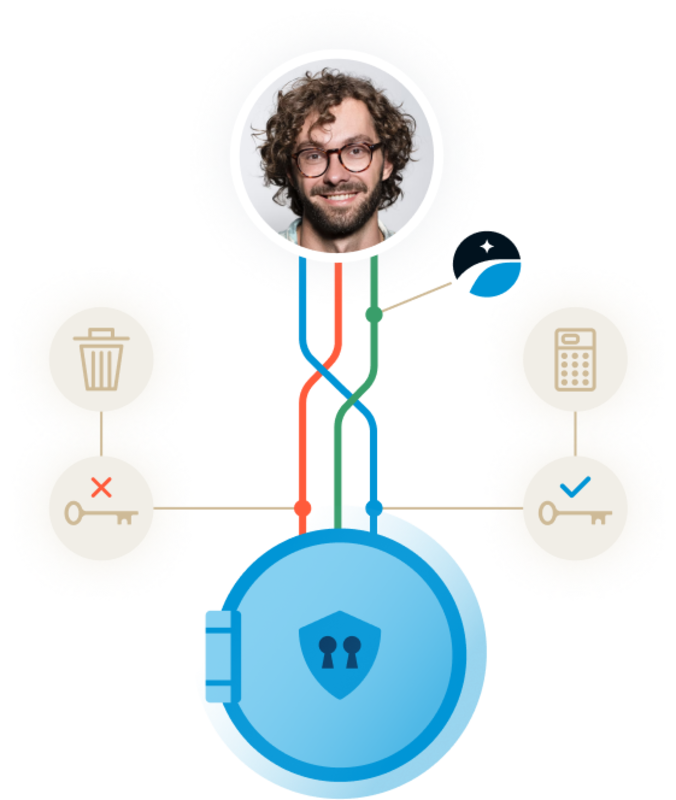

Bitcoin self-custody is typically defined by who possesses the power to spend the bitcoin. If you hold bitcoin in self-custody, then you’re the only one with unilateral power to spend your bitcoin. Collaborative custody means you’re collaborating with another party to help you manage or spend the bitcoin. In a 2-of-3 multisig where you hold two keys and a collaborative partner holds one key, both features are available! You can still move your bitcoin without relying on the collaborative partner, but you can also receive assistance from them when needed. Additionally, your collaborative partner cannot move your bitcoin without your consent.

Collaborative custody multisig can be set up with two or more people. If you have someone in your life that is technical and trustworthy, you could work with that person to set up collaborative custody. However, the most popular approach is to form a partnership with a business that specializes in collaborative multisig. Choosing an established company with a great reputation will grant you access to a team of experts you can trust for help, without giving up control over your bitcoin.

If you work with one or more collaborative key agents, you will simplify your setup by reducing the number of items you need to keep track of yourself. The partnership can also provide you with a resource to help you think through wallet maintenance, such as retaining the wallet configuration information, re-securing your bitcoin if a key becomes lost or compromised, navigating technical difficulties, and managing UTXOs. An institutional collaborative partner can provide the added benefit of actively monitoring for any suspicious activity in connection with your bitcoin wallet, as well.

Trade-offs

Privacy

As mentioned previously, collaborative custody will typically involve sharing some information with your collaborative partner about your bitcoin. This is necessary to get the most value and support out of the relationship.

In most cases, your collaborative partner will be able to see your bitcoin balance, and observe the bitcoin addresses that you interact with while sending and receiving bitcoin. This is why you should only ever consider collaborative partnerships with people or businesses you can trust to respect your privacy.

At Unchained, we are transparent about this reality. The privacy of our clients is taken seriously, and you can view the details of our privacy policy here.

Ease of setup and operation

The biggest downside to attempting multisig on your own is the lack of reliable technical support available for you and your beneficiaries. Multisig is more involved than singlesig, and has several components that must be properly managed. Otherwise, you might find yourself in a difficult situation when trying to access your bitcoin in the future.

For example, you will need to know a little about xpubs and BIP 32 derivation paths to understand the specifics about how your multisig wallet is configured. This information can be found in a wallet descriptor or wallet configuration file, which is an important item you will be responsible for keeping in your possession. If this file is lost, then you are at risk of losing access to the bitcoin in your multisig wallet, even if you still have a controlling number of keys within the multisig quorum.

Additionally, with an abundance of bitcoin software and hardware designed by various parties, you may run into occasional interoperability issues that can be confusing and frustrating to navigate. These bumps in the road are not uncommon while using bitcoin, and multisig can add another layer of complexity. If you aren’t very technical, or confident about the mechanics of bitcoin and multisig, you may need to rely on outside assistance in these situations. Without an established collaborative partnership, you may be vulnerable to receiving incorrect (or even malicious) advice.

Spending convenience

If you want to get the most out of multisig, then you’ll want to geographically separate the keys. Keeping the keys together in the same location would resemble a more cumbersome version of singlesig. Separating the keys is what adds security and removes single points of failure, but it will also mean that it’s less convenient to make a withdrawal.

If you operate a multisig wallet on your own and separate the keys, then you will have to travel to different locations in order to take any bitcoin out of your wallet. This might not seem like a big deal, if you are holding your bitcoin savings for the long term, and have no plans for regular withdrawals. However, you could still be put into a difficult position if a situation occurred where you needed to access your bitcoin, but your movement was restricted due to unforeseen circumstances, such as a local crisis.

If you use a collaborative custody setup, such as a 2-of-3 quorum where you keep one key at home, one key away from home, and a key agent partner holds the third key, then you have an avenue to accessing your bitcoin that doesn’t require travel. You can sign a withdrawal using your key at home and call upon your collaborative partner to use their key, so that your bitcoin can be spent more conveniently.

Inheritance

Even if you are personally confident with the technology behind bitcoin and multisig wallets, a concern might be inheritance. If you want your beneficiaries to have access to your bitcoin in the event of your death or…