Technical Forecasts for Bitcoin Price for 2024 and 2025

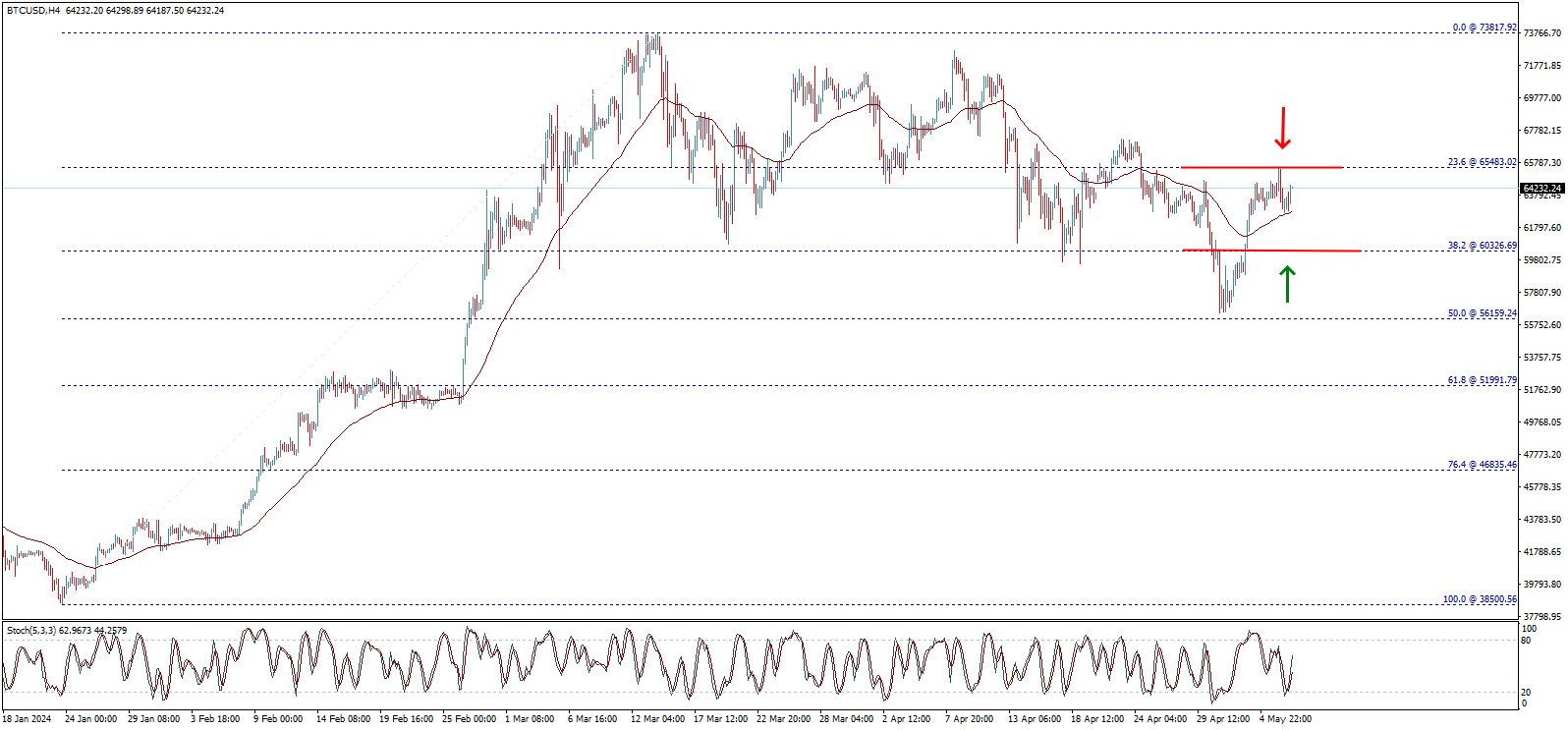

- As 2022 draws to a close, the price of Bitcoin begins to rise, showing signs of a long-term upward trend, anchored at $15,450.00 and climbing to record historical peak levels reached in mid-March of the current year, where the price reached $73,817.92, and from there began some downward correction that tested the 23.6% Fibonacci level at $60,039.77, after attempts to break it, it returns to try to recover and stabilize above it.

Best Bitcoin Trading Platforms for 2024 and 2025

Licenses:

CySEC, ASIC, IFSC

Plus 500 is subject to DFSA regulation. CFD service. Trading carries risks.

XM

Licenses:

CySEC, ASIC, IFSC

Price transactions have recently stabilized around the Exponential Moving Average 50, and we note that the Stochastic indicator is losing positive momentum, which may press the price to attempt a decline again and undergo new downward corrections.

In the shorter term, we find that the price has undergone an additional bearish correction and approached the $56,000.00 barrier, but it collided with strong resistance areas around $65,480.00, presenting additional signals of a possible decline during the coming period.

Now, we are at an important crossroads for the price of Bitcoin, the parties of the conflict are represented by the support at $60,325.00 and the resistance at $65,480.00, and the price needs to exceed one of these levels to confirm the next direction more clearly.

- We point out that breaking the mentioned support will pressure the price to undergo an additional bearish correction reaching its next target at the $51,515.00 areas, while breaking through the resistance represents the key to the resumption of the overall upward course and achieving new gains starting with testing areas of $70,000.00 and then $73,815.00 primarily.

To determine the superiority of the next direction, we can look at the shorter time frames, to find that the price is drawing an inverted head and shoulders pattern shown in the following picture, the confirmation level of this pattern is located at $64,500.00, which means that breaking this level will push the price to launch upwards again and achieve positive goals that almost meet the targets of breaking the mentioned resistance, starting from $70,000.00 and reaching $72,500.00, to gain positive factors expected to contribute to pushing the price of Bitcoin to regain its health and the main upward path again.

In summary, the price of Bitcoin faces conflicting technical factors that may cause mixed and unclear trading initially, but there is a preference to resume the main upward trend after the downward correction recently conducted by the price, with the indication that confirming the resumption of the upward trend requires a confirmed breakout of the $65,000.00 level and stability with daily closures above it, and then surpassing the $70,000.00 barrier to add more confirmation to the resumption of the long-term upward trend and stop any chance for a new downward correction.

Conversely, it is necessary to pay attention to that breaking the $60,000.00 barrier and staying below it will put the price under new negative pressures starting with targeting the $56,000.00 areas and extending to $51,515.00 before any new attempt to recover.

Best Bitcoin Trading Company for 2024 and 2025

- Plus500, the best global trading company, trusted and licensed for Bitcoin trading.

- XM, the best reliable and suitable platform for beginners in Bitcoin trading.

| Licenses | FCA, CySEC, ASIC |

| Minimum Deposit | $100 |

| Trading Platforms | WebTrader, Windows 10, Mobile Apps |

| Assets Coverage | Forex, CFDs, Stocks, Commodities, Cryptocurrencies, Indices |

| Customer Support | 24/7 |

| Account Types | Regular, Professional |

Disadvantages

- User country restrictions

Advantages

- High-security trading platform

- User-friendly trading platform

- Licenses from several leading regulatory bodies worldwide

Plus 500 is subject to DFSA regulation. CFD service. Trading carries risks.

| Licenses | CySEC, ASIC, IFSC |

| Minimum Deposit | $5 |

| Trading Platforms | MT4, MT5, WebTrader |

| Assets Coverage | Forex, CFDs, Stocks, Commodities, Cryptocurrencies, Indices |

| Customer Support | 24/7 |

| Account Types | Multiple, including Islamic accounts |

Disadvantages

- Cannot purchase Bitcoin outright

Advantages

- Educational materials for traders

- Easy deposit and withdrawal

- High security and transparency standards

- Helps traders develop strategies

Fundamental Analysis of Bitcoin Price for 2024 and 2025

In mid-March last year, Bitcoin prices succeeded in recording a new record level of approximately 74,000 US dollars, within an upward market that dominated the transactions of the digital asset. This was thanks to massive positive developments concerning the regulatory, technical, and fundamental framework for the world’s largest cryptocurrency.

These developments include the continuous flows into the new instant investment funds, widespread purchases from major companies and institutions, and predictions of a supply shortage due to the halving event, in addition to the possibilities of cutting global interest rates, especially in the United States.

With the investment in the cryptocurrency “Bitcoin” moving to a more attractive environment, many global institutions and banks began to adjust their future expectations about the levels that the world’s most important cryptocurrency can reach over the years 2024 and 2025.

The expectations have become more aggressive with the likelihood of reaching the important psychological barrier at 100,000 dollars per Bitcoin unit for the first time in history during the remaining period of this year, with even higher levels expected next year.

Brief Analyses and Predictions for Bitcoin Prices

- Bitcoin price predictions this week: After recording the highest level in two weeks above the $65,000 mark, some analysts expect the prices to continue rising until the important psychological barrier at $70,000.

- Bitcoin price predictions in May: It is likely that the world’s most important digital currency will resume its monthly gains in May, after suffering a loss last April for the first time since August 2023.

- Bitcoin price predictions in 2024: With surpassing the record level near $74,000, the path is open for recording many historical levels, with the target being the important psychological barrier at $100,000.

- Bitcoin price predictions in 2025: In case of strongly surpassing the $100,000 barrier, the next targets for the cryptocurrency prices might be at $150,000 and then $200,000.

Billionaire Robert Kiyosaki Predicts Bitcoin Price to Reach 100,000 Dollars

In the latest predictions from the author of the famous book “Rich Dad Poor Dad,” billionaire Robert Kiyosaki, he expected that the price of Bitcoin will reach 100,000 dollars by next June.

Kiyosaki has been a supporter of the digital currency Bitcoin for many years, and he often praised the digital asset, along with gold and silver, over “fake” paper currencies like the US dollar.

Kiyosaki said in a post on the “X” platform: that central banks are buying gold and not US bonds (debt). It is likely that gold will crash below the $1,200 level, which means a boom for silver and Bitcoin as well.

Instant Bitcoin ETFs Traded on American Exchanges

On Wednesday, January 10, 2024, for the first time, the US Securities and Exchange Commission “SEC” approved Exchange Traded Funds “ETFs” that invest directly in Bitcoin.

The regulatory authority in the United States granted permission to 11 funds to start official trading in the United States on Thursday, January 12, 2024, with the funds related to “BlackRock” and “Fidelity” at the forefront.

The Securities and Exchange…

Read More:Will Bitcoin price reach $100,000 in 2024? Halving analysis & best brokers for trading it